What We Do

We Are A Full Service Digital Marketing Firm That Does A Lot More Than Just Generate Leads For Career Colleges, Trade And Technical Schools.

Web Services

We craft visually captivating and user-centric websites that enhance brand presence and drive optimal engagement

Content Creation

We deliver tailored messaging across various platforms to entice audiences and achieve company goals

Paid Advertising

We offer strategically targeted campaigns across diverse channels that amplify brand visibility and drive results

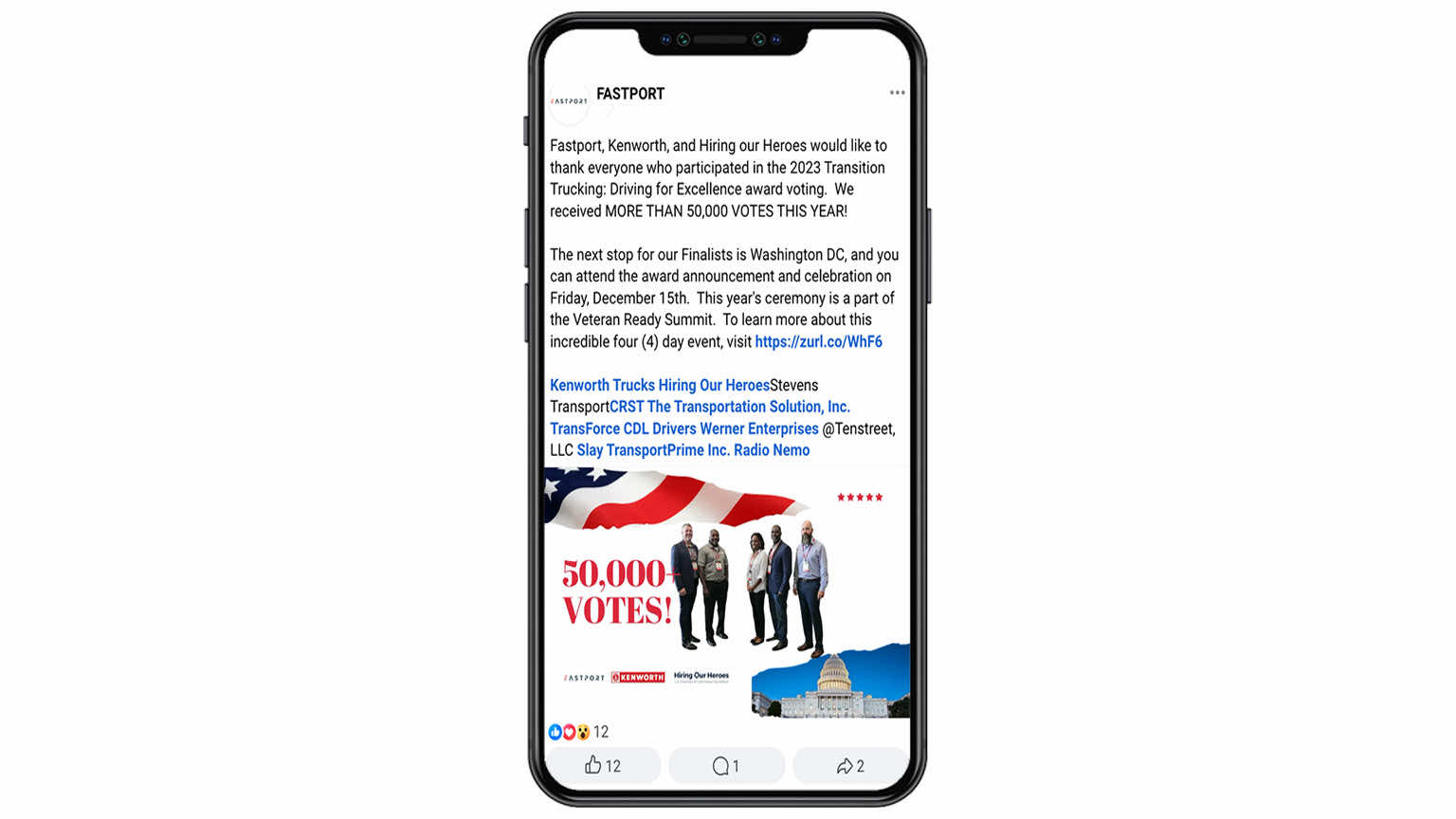

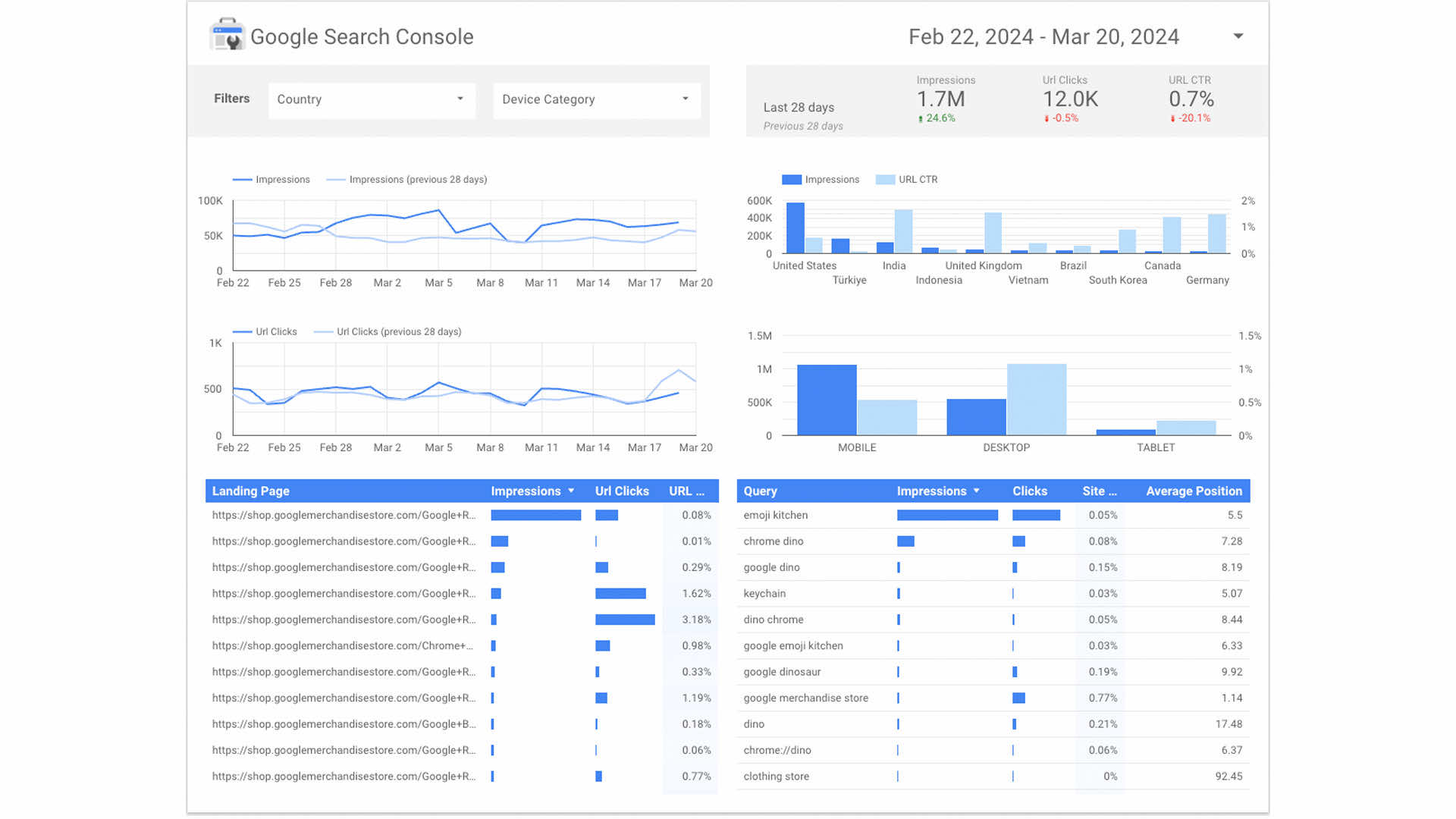

What We’ve Done

With a diverse array of successful campaigns spanning various industries, our digital marketing agency pride ourselves on delivering innovative techniques that captivate audiences and drive tangible growth for our valued clients.

Who We Are

30+ YEARS OF MARKETING SOLUTIONS

Paradigm Digital Group is one of the most experienced marketing, lead generation and digital marketing agencies serving the Transportation, Trade School, Vocational and Career College industries.

For over 30 years, Paradigm Digital has navigated the ever-changing landscape of lead generation and continues to create innovative solutions for private schools and colleges throughout North America.

Evolution of Ideas

Through continuous adaptation, our digital marketing agency has achieved significant growth and strengthened its position as a leading innovator in the industry.

Successful Projects

PDG has proven its capacity to conceive and execute meaningful projects, resulting in remarkable growth and success.

MEET THE TEAM

From strategic masterminds and visionary designers to persuasive copywriters and data-driven analysts, our diverse digital marketing agency's team collaborates seamlessly to elevate your brand and drive unrivaled success.

Deb Rishel

President

Bob Newman

Chief Marketing Officer

Mike Curts

Vice President of Marketing

Karen Thacker

Business Office Manager

Eric Knifong

Video Producer

Evan Castor

Videographer/Editor

Lawson Hearne

Digital Strategist

Sidney Mireles

Digital Marketing Specialist

Destiny Harvel

Digital Marketing Specialist

Patrick Beatty

Digital Marketing Account Manager

Chelsea Cook

Digital Marketing Coordinator

Samuel Jennings

Video Intern

WHAT CLIENTS SAY ABOUT OUR COMPANY

We are honored to work with a wide variety of clients, ranging from startups to large companies.

There are so many companies out there just trying to “sell” you leads. As a School owner, I’ve trusted Paradigm Digital Group for over 25 years to make the best decisions for us. They have been one of our most valued Partners.